AMP S.A. - Fourth Quarter and Full Year 2023 Results

Published February 22, 2024

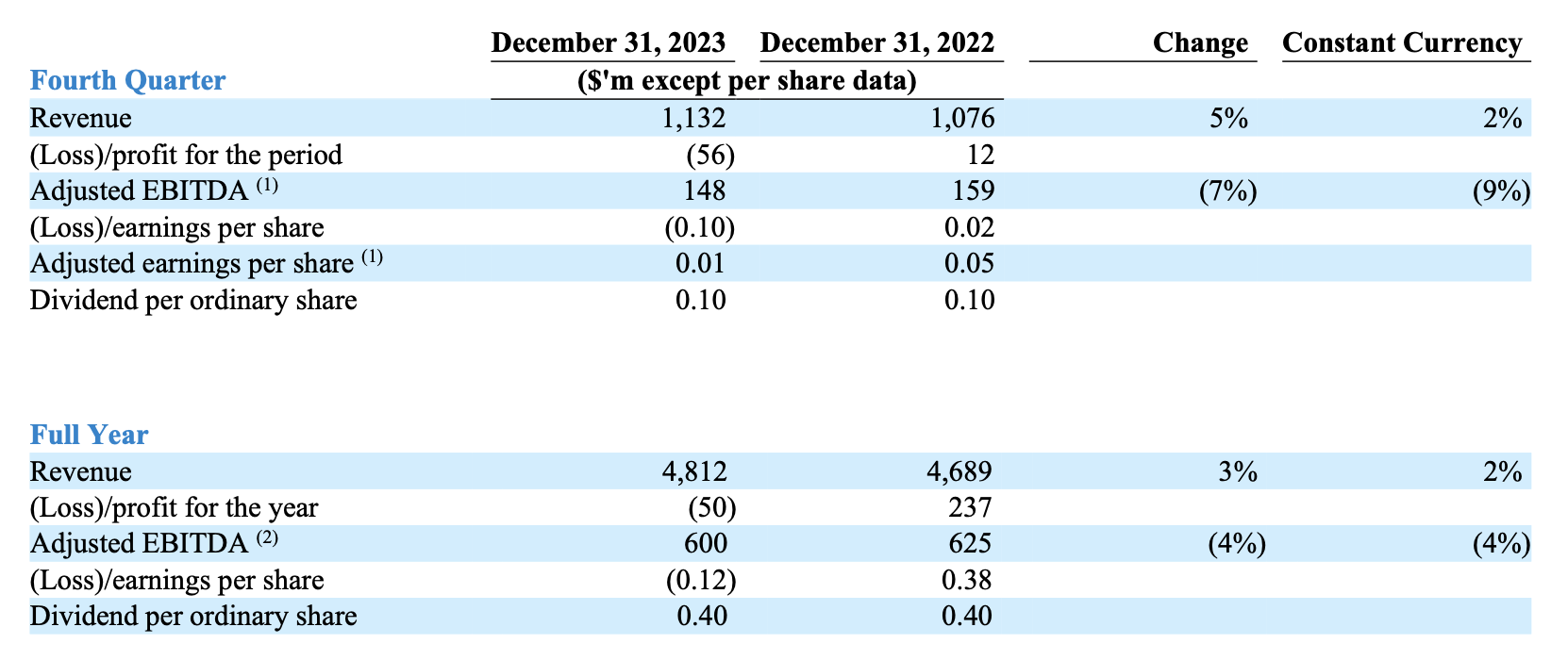

Ardagh Metal Packaging S.A. (NYSE: AMBP) today announced results for the fourth quarter and year ended December 31, 2023.

Highlights

Oliver Graham, CEO of Ardagh Metal Packaging (AMP), said:

“2023 represented a year of transition for our business, as the team navigated a challenging macro demand environment and took decisive actions on our footprint and inventories to position the business for earnings growth in 2024 and beyond. Despite this market context – in particular softer European demand – we achieved record global revenues and shipment volumes, growing by 5%, driven by strong growth in the Americas. Our team’s efforts on working capital management drove a near trebling of cash generated from operating activities, resulting in AMP ending the year in a robust liquidity position.Our fourth quarter performance was negatively impacted versus our expectations by weaker than forecast sales volumes and orders in Europe that went beyond consumption trends, primarily reflecting customer destocking actions. This was partly offset by a stronger than expected performance in Americas.

Our confidence in a stronger performance in 2024 reflects our expectations for improved cost absorption due to our contracted pipeline of volume growth in the Americas and our footprint actions. Consumer sentiment and spending remains soft, notably in Europe, but inflationary pressures are moderating and the beverage can continues to win share as the package of choice, backed by customer innovation and its sustainability advantages. With our well-invested global network and a strong diverse mix of customer relationships we remain well placed to benefit from a normalisation in demand, which should drive further earnings growth over the medium-term.”

- Global beverage can shipments grew by 5% for the full year versus the prior year, which was driven by growth of 11% in the Americas with stronger second half momentum. European volumes declined by 2%, reflecting weakness in the second half.

- Global beverage can shipments grew by 2% in the quarter versus the prior year quarter, which was driven by growth of 14% in the Americas reflecting continued strong growth in North America and a further recovery in Brazil, which also lapped a weak prior year comparable. European shipments declined by 10%, below expectations, reflecting a sharp contraction towards the end of the quarter as customers destocked into year-end and closed production facilities earlier than usual for the holiday period.

- Americas Adjusted EBITDA for the quarter increased by 3% to $117 million as the contribution from higher volumes was partly offset by higher operating costs.

- In Europe, Adjusted EBITDA for the quarter decreased by 31% to $31 million due to lower volume/mix and increased fixed costs, as finished goods inventory was right-sized – earlier than expected in response to customer demand – resulting in higher fixed cost under-absorption from reduced production activity and a lower period end contract asset balance. The impact offset stronger input cost recovery versus the prior year and currency effects.

- Remain committed to balancing AMP’s network capacity with demand, through a mix of curtailment and longer-term action as appropriate. Remaining steel lines in Weissenthurm, Germany were closed at the end of the year. The closure of the Whitehouse, Ohio facility in February 2024 and expected growth will improve utilization in North America to a more balanced position.

- Total liquidity of $812 million, including cash of $443 million, at December 31, 2023 was boosted by a further working capital improvement versus expectations. Record cash inflow for the year from operating activities includes a $270 million working capital inflow more than offsetting a prior year $202 million outflow, predominantly from destocking. Working capital in 2024 is expected to see a further inflow.

- Growth capex of $266 million in 2023 was 10% lower than guidance and declined by 45% on the prior year. Growth capex of approximately $100 million is expected in 2024, with a further reduction anticipated in 2025. Near term investment comprises the tail-end of the growth investment program, and flexibility enhancements to optimize the network.

- Net leverage reduced by 0.2x during the quarter through strong cash conversion. Modest deleveraging anticipated in 2024 through Adjusted EBITDA growth and lease principal repayments, with a more meaningful reduction thereafter.

- Regular quarterly ordinary dividend of 10c announced. No change to capital allocation priorities.

- During the quarter, the publication of the 2023 sustainability report highlighted progress on sustainability initiatives and the announced supply agreement with Novelis in North America for supply from its greenfield development will further contribute towards AMP’s metal decarbonisation strategy. Ardagh Metal Packaging alongside other industry stakeholders also participated in a call for action at COP28.2024 outlook:

- Shipment growth approaching a mid-single digit % and full year 2024 Adjusted EBITDA in the range of $630-660 million.Growth supported by shipments growth with improved fixed cost absorption accelerated by the completion of finished goods destocking and footprint rationalization.

- First quarter Adjusted EBITDA in line with the prior year quarter (Q1 2023: $130 million reported; $129 million at constant currency), with growth expected in the Americas but with Europe lower, as volume recovery is weighted towards the second half.